If You Pay a Loan Off Early Can You Borrow Again

Affirm And Your Credit Score

How To Pay Off Your Mortgage Early

When you sign up for an Affirm point-of-auction loan, you are taking a credit instrument. But Affirm doesnt perform a hard credit check, only a soft pull on your credit information, then only taking out the loan volition non bear upon your score.

However, if y'all pay back the loan on time, youll experience a boost to your credit score, which helps you get financing from the banks. Its of import to note that the converse is likewise true. If you dont pay dorsum your loan on time, miss payments or are belatedly with payments, it will touch your credit score negatively.

Affirm Tin Assistance You Avoid The Siren Song Of Minimum Payments

Ideally, you might have admission to a credit card with an introductory APR of 0% for 12 to 15 months. Then youd exist able to finance your buy without paying whatever involvement, provided y'all were able to pay it off before the introductory period concluded and your interest rate shot upward.

However, if yous dont have access to those kinds of offers, or you know youre liable to give in to the siren song of making only minimum payments and pocketing the extra greenbacks to spend elsewhere, then Affirm might be the better deal for yous.

Affirm offers you lot concrete terms and a fix repayment plan with a fixed monthly payment over a fixed amount of fourth dimension. No need to worry about your own willpowerthis will just exist another monthly beak that is due in full. Exercise you ever waffle on paying your electrical beak? I hope non.

Thats not to say that using Affirm is completely chance-free, still. Like any credit product, it needs to be used responsibly. If youre a seasoned professional musician whose amp just got stolen on the beginning week of your comeback tour? Using Affirm to buy a new ane is a no-brainer.

Nevertheless, if youre a CPA who once played tuba in high school whos convinced you could be the second coming of Jimi Hendrix, if merely you could get that sugariness electric guitar youve been eyeing? Maybe rethink information technology. Making foolish purchases via Assert is only slightly smarter than making them via a credit card with a high April and major belatedly fees.

My Experience With Affirm

Affirms website appears to offering a user-friendly catalogue of its partner brands.

If you lot hover over Store on the homepage, youll meet some shopping categories such as Travel and Electronics. Just if y'all click on any of those categories, the website display is wonky at best. And when you click View all to run across a full list of brands, you take to create an account to go to the actual list.

Fifty-fifty one time you create your account, the Affirm app is much easier to navigate than the website.

Again, Affirm is wonky. It required me to generate a one-time-use virtual menu from the checkout folio when I was ready to purchase. But it didnt allow me complete the transaction from my laptop.

I had to navigate back to the retail brand from within the Affirm app and relocate my purchase. I had selected two items from the shop originally, just I forgot well-nigh the 2d detail by the time I switched to the app.

So when I completed that buy, Affirm told me there was still coin left on the virtual bill of fare. Just when I located the second particular and tried to re-input the card details , the transaction failed.

Affirm originally gave me $100 on my virtual card. I paid zippo up forepart just had payments scheduled for $33.33, $33.33 and $33.34 listed on my account, along with an unused amount of $25.46 on the virtual carte.

The app did offering a toggle switch that allowed me to automate my payments, even though that wasnt the default setting.

Read Likewise: What Credit Score Is Needed For Usaa Auto Loan

Affirm Involvement Rates And Loan Details

Affirm offers small personal loans, which ways y'all can typically infringe between $50 and $17,500 and take iii to 36 months to repay the loan.

Once you apply for an Affirm loan online, youll receive a decision right abroad. If approved, your gild volition exist processed immediately and the loan will be funded.

| Fixed rates | |

| 3, 6, or 12 months* | |

| Min. credit score | |

| Must be a resident of the U.Southward. or its territories | |

| Loan use | |

| |

| Best if |

|

| *Very small loans might be limited to one-3 month terms, without the selection to pay over time. Very large loans might have the option for 48-calendar month terms. |

Why Was I Prompted For A Down Payment

Affirm isn't always able to offer credit for the full amount you request. In these cases, Assert asks y'all to brand a down payment with a debit card for the residual of your purchase. The downward payment corporeality can't be changed and must be made upon confirming your loan and before the loan offer expires.

Too Cheque: Usaa Pre Authorize Motorcar Loan

Its Got An Crawly App

Affirms easy-to-utilize app makes purchasing flights on mobile a completely seamless experience. Not just can you use the app to spread the price of your flights with Alternative Airlines, but you can also make any other Affirm buy. The app is as well a great fundamental platform where you tin manage your account and view and make payments on any existing loans.

What Happens If I Pay Off My Loan Early

If you pay off your unabridged loan earlier the final due engagement, you will pay interest just for the menstruum that yous borrowed the money. Affirm rebates any unearned portion of a finance charge for the remaining loan period. The total pay-off amount displayed in your Assert business relationship online reflects this rebate. In that location are no hidden penalties for paying off your Assert loan early.

Does Assert perform a credit check?Assert does a credit bank check to verify your identity and provide you with a financing offering when you sign upward. This is a soft credit check and will non bear upon your credit score. If you choose to complete a buy and finance it with Affirm, nosotros will practise a single hard credit check when your first order is candy by the merchant. This may accept a minor impact on your credit score. For future purchases with Affirm we wont need to check your credit again.

Why was I prompted to pay a down payment with a credit card?We effort hard to approve every purchase with Affirm but sometimes nosotros deceit corroborate the full amount. When this happens, Assert provides a debit carte du jour down payment selection so that y'all may even so consummate your purchase right away.

Too Bank check: Does Va Loan Piece of work For Manufactured Homes

Why Is My Affirm Interest Rate So High

When Affirm determines your annual percentage rate , it evaluates a number of factors, including your credit score and other data near yous. If you finance futurity purchases with Affirm, you may be eligible for a lower April depending on your fiscal situation at the time of purchase.

This Apr calculator will requite yous an idea of how much interest yous really pay:https://world wide web.affirm.com/apr-computer/

When y'all consider Assert financing, advisedly evaluate the loan terms that Affirm offers y'all and determine whether the monthly payments fit your upkeep.

Pay Off Your Assert Balance Over Time

3 Hacks to Pay Off Your Habitation EARLY-Paying Off Your Mortgage

Once you buy successfully with Affirm, youll go the first reminder to make payments in almost a month.

Affirms loans are mostly brusque term, extending over a year at nearly. You tin can pay off your loans in

- three monthly payments,

- half-dozen monthly payments, or

- twelve monthly payments.

You tin also cull to pay off your loan early or in 1 total payment Affirm will not charge you actress.

Affirm loans are non-revolving yous would need to apply separately to finance each buy.

Balances overlap, and its not a trouble. Theres no limit to how many loans you can get with an Affirm account at one time.

Don't Miss: How To Use Va Loan For Investment Property

Assert Personal Loans Review

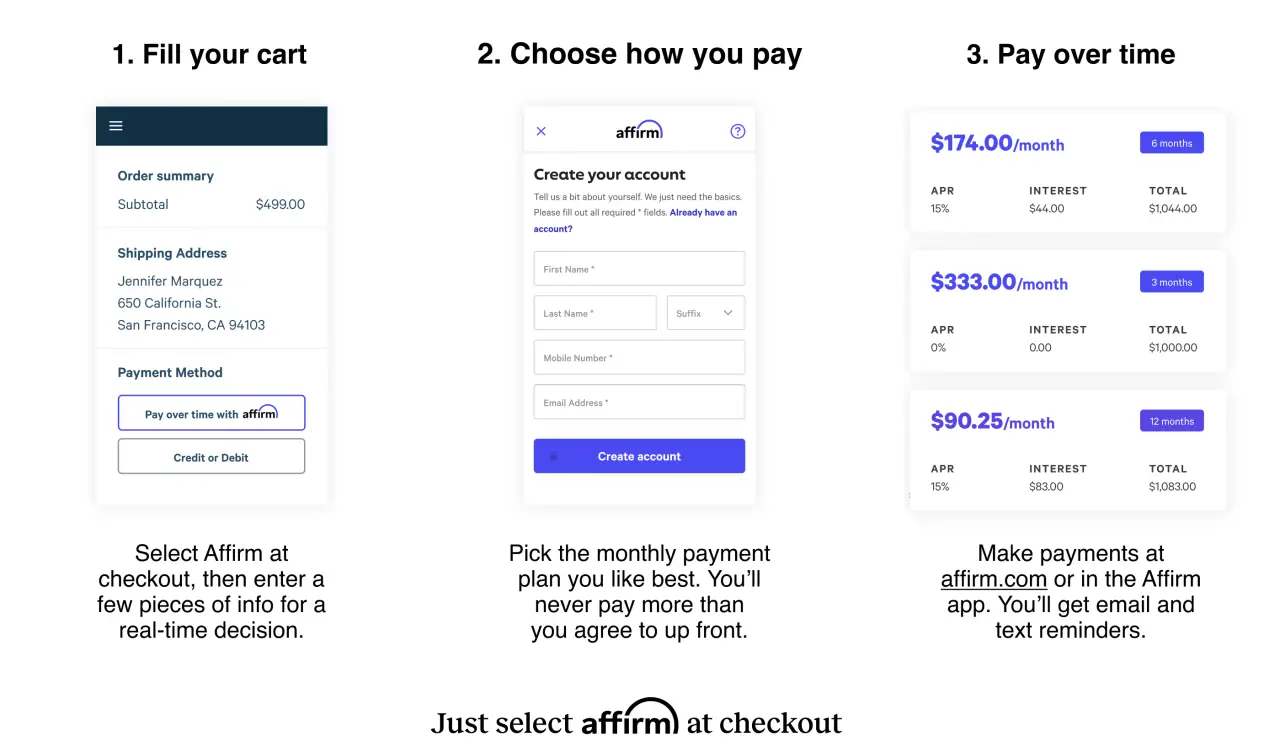

With an Affirm personal loan, you lot can buy now and pay for purchases over time with fixed monthly payments.

Edited byAshley HarrisonUpdated Oct 14, 2021

Our goal is to give you the tools and confidence you lot need to improve your finances. Although we receive compensation from our partner lenders, whom we volition ever identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to hither as "Credible."

Best if:

- You dont have access to credit cards

- You need to brand a purchase, but dont have enough money saved

While going into debt is never ideal, there are times when y'all have to brand a purchase before you take the coin saved. If you dont accept a credit card or dont have the credit to authorize for a low-interest personal loan, theres some other alternative: Affirm personal loans.

With Affirm, you can take out a personal loan to comprehend purchases at major retailers like Walmart and Rooms To Become. But Assert isnt for everyone. While Affirm reviews frequently focus on its convenience, you should exist aware of its involvement rates and other drawbacks like a potentially negative touch on on your credit earlier making a purchase.

Heres what you should know earlier taking out a loan with Assert:

- How Affirm tin can improve

What Happens If You lot Don't Pay Affirm

We don't charge late fees. Even and so, fractional payments or late payments may hurt your credit score or your chances of getting another loan with united states of america. After you schedule a payment, nosotros'll continue sending reminders by email and text message until any remaining remainder is settled, but yous won't receive calls about your loan.

Yous May Like: Usaa Auto Refi Rates

Can Affirm Deny Y'all

The principal reason Affirm usually denies payment is that their systems cannot verify who you are. To complete payment via Affirm the company must exist able to confirm your identity so they can check that you are credit worthy. In almost cases, your full name, address and phone number is plenty to check your identity.

Why Does Affirm Need My Ssn

How does Assert approve borrowers for loans? Affirm asks for a few pieces of personal data: Proper noun, email address, mobile phone number, date of nascency, and the terminal four digits of your social security number. Affirm verifies your identity with this information and makes an instant loan decision.

Read Besides: Usaa Used Car Loan Rate

How Is Involvement On An Affirm Loan Calculated

Affirm calculates the annual percent rate of a loan using simple interest, which equals the charge per unit multiplied by the loan corporeality and by the number of months the loan is outstanding.

This model differs from compound interest, in which the involvement expense is calculated on the loan corporeality and the accumulated interest on the loan from previous periods. Think about chemical compound interest every bit "involvement on involvement," which can increase the loan amount. Credit cards, for example, utilise compound interest to calculate the involvement expense on outstanding credit card debt.

Is In that location A Credit Limit

Affirm doesn't have a minimum or maximum , per se. Though there is an upper limit of $17,500 on purchases as mentioned, your individual credit limit is determined by things similar:

- Your credit history

- Your payment history with Affirm

- How long you've had an account with Assert

- The interest rate offered by the merchant where you're applying

What this all means is that information technology's possible to be approved for more 1 Affirm loan at a fourth dimension, with more one merchant. Affirm too mentions that information technology takes current economic atmospheric condition into business relationship so whether or not yous're canonical and your credit limit tin can depend on things across your fiscal history.

Don't Miss: Usaa Rv Loan Rates Figurer

Is It Better To Utilise Affirm Or A Credit Card

If you accept access to a credit card, its the amend option if yous make full use of the grace period but so repay your bill before incurring any interest charges. Notwithstanding, if youre like many Americans and prefer to continue the credit carte du jour for emergencies, Assert is a viable alternative.

While your credit bill of fare might have a $15,000 limit, your banking company or card issuing authorization probably doesnt want to see you have an outstanding residual of more than $5,000 at whatsoever fourth dimension. If you lot go over this ratio, youll finish upward affecting your credit score.

Since Affirm offers loans upwards to $17,500, its the platonic option for financing a bigger-ticket item as opposed to using your credit carte du jour.

Withal, there are some issues with using Assert. The company can charge a loftier interest rate, and if youre getting an xviii% APR on your carte, you tin can await the rate at Affirm to exist similar or higher. However, you get flexible spending limits, with up to 12-months to pay off your purchase.

Some retailers may partner with Affirm to offer a 0% APR on sure purchases.

Terms And Apy: What Does Assert Offer

How to pay off your car loan fast – Pay off car loan early

If you do authorize, its important to read the fine print earlier you accept. Once again, Assert loans tin range from 0 to 30% interest, and from i to 48 months, though most often, the terms are three, 6 or 12 months. Its of import that you understand the specifics before accepting.

Some merchants offer 0% APY for a limited fourth dimension or for qualified purchases. According to CNBC, Affirm says about 43% of its loans offering 0% APY.

The merchant, your credit score and the amount you asking all bear on your interest rate, the terms and even whether yous need to make an immediate payment . Affirm sometimes requires an initial eolith of up to 50%.

Youll click Ostend Loan to accept the companys offer. Your first payment typically will be due within 14 or 30 days of your initial confirmation.

You tin can pay with a debit menu, bank check or via your bank account. Its possible to ready automated payments. Affirm volition send you text message or email reminders most your upcoming payments.

According to CreditCards.com, the average interest rate on a credit bill of fare in the Us was 16.22% equally of Sept. 15, 2021. So your interest could be 0%, or it could be much higher than what an boilerplate credit card offers.

Theres no penalisation for paying off an Affirm loan early. Remember that the longer your term extends, the more than interest youll ultimately pay. If youve ever bought a car, youre probably familiar with the sales tactic where your monthly payments are lower, but you pay for longer.

Likewise Check: How Much Machine Can I Afford Calculator Salary

Affirm Review: How Does It Work

- Taxes

Shopping online is more popular than always When COVID-xix hit the The states, millions of consumers turned to the internet to buy things from dwelling theyd unremarkably shop for in stores.

The purchase now, pay later on concept, planted in the United States several years ago, took root and grew similar wildfire. Assert, one of the largest companies in the manufacture, works with some large-fourth dimension retailers to offer installment loans.

What is Affirm, how does it work and is it something you should consider using?

Does Affirm Perform A Credit Check

Yes, when you start create an Affirm account, we perform a soft credit check to help verify your identity and decide your eligibility for financing. This soft credit check should not accept an effect on your credit score. If you choose to confirm a financing offer, we will perform a hard credit check when a merchant processes your order. This hard credit cheque volition accept some effect on your credit score.

Assert will not perform another difficult credit check unless you confirm another financing offer more than one year after your offset Assert loan.

Also Check: Veteran Loans For Mobile Homes

Admission Purchase Financing With A Diversity Of Affirm Personal Loan Rates

Our editors independently research and recommend the best products and services. You can larn more most our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Affirm Logo

Affirm offers personal loans for online purchases through retailers that are willing to offer payment plans. Payment terms, rates, and other details vary according to the retailer, and purchasers can select their payment schedule. Assert charges no fees, and theres either simple, stock-still interest or no interest on transactions. You tin can see an guess of how much you tin can spend based on your fiscal data, simply there are no loan limits. If youre approved, Affirm grants instant financing for purchases you lot make online.

Nosotros collected more than than 25 data points across more than 50 lenders, but Affirm was not one of the best companies nosotros institute.

- Product Specifications

- Recommended Minimum Credit ScoreNot bachelor

- Loan Amounts$50 to $17,500

- Loan TermsVariable commonly 3, 6, or 12 months

-

Might help improve your credit

-

Interest rates can exist high

-

Only available with specific retailers

-

No refund on interest paid

-

No rewards programme

-

Non every loan will improve your credit

Assert doesnt charge any late, prepayment, origination, or other fees.

Affirm Logo

- Methodology

Reasons To Buy Flights With Affirm

Culling Payment MethodsHow to get cheap airfares and the myths surrounding information technology is as hot of a topic as its ever been. And while weve given our ain thoughts on the field of study, fifty-fifty the most tried and tested methods nevertheless have a fair bit of ambiguity surrounding them.

We at Alternative Airlines believe that your efforts are much meliorate aimed at how you pay, rather than what y'all pay. Thats why weve partnered with Affirm and given qualified US residents the ability to buy their flight tickets on finance and spread the price of them over short amount of fourth dimension or in monthly installments. Paying back the cost of your flight in smaller monthly payments tin make air travel so much more affordable than paying the total toll upfront.

Whether it'southward to brand 4 interest payments for smaller purchases or longer term loans, you lot have the flexibility.

Heres xiv reasons why y'all should buy flights using Affirm with Alternative Airlines.

Alternative Airlines Managing director, Sam Argyle, meets Assert

Too Check: What Credit Score Is Needed For Usaa Automobile Loan

grasssamissing1973.blogspot.com

Source: https://www.understandloans.net/how-to-pay-off-affirm-loan-early/

0 Response to "If You Pay a Loan Off Early Can You Borrow Again"

Post a Comment